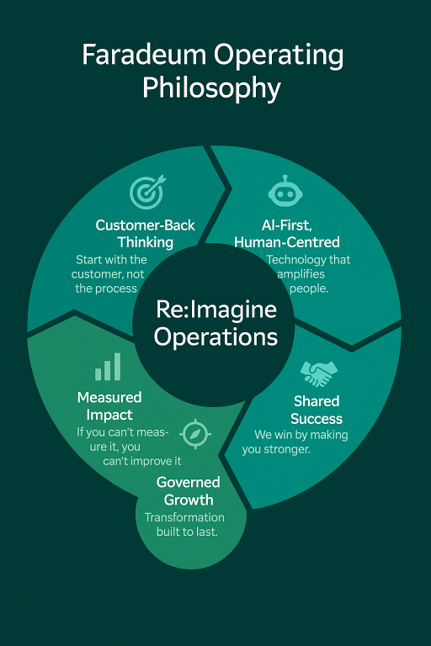

Real Results, Measurable Impact

Mini Case Stories:

Industrial Carve-out (PE backed): Implemented cloud-native systems, reducing TSA from 36 to 15 months; IT costs decreased by 30%

Energy Portfolio Integration: Unified back-office via Launchpad, achieving synergies 3 months early

Medical Device Spin-off: M&A Ops team delivered $10.6 million EBITDA improvement in 24 weeks

Accelerators Recap:

Faradeum leverages five key accelerators to drive results: Ops.AI, Scale X, Launchpad, M&A-in-a-Box core, and iCX. Each accelerator is designed to streamline processes, enhance transparency, and accelerate value capture.

Proof of Performance:

Cost reduced by 40%

Process speed increased by 70%

ROI achieved in 6 months or less

Reliability 99%

Adoption increased by 40%

Client Quote:

“Faradeum digitized our carve-out. We exited TSAs six months early and delivered synergies ahead of schedule.” – PE Operating Partner